Which County In Kansas Has The Highest Taxes

Emporia KS Sales Tax Rate. 645 The total of all income taxes for an area including state county and local taxes.

Which Texas Mega City Has Adopted The Highest Property Tax Rate

The mean property taxes for this county are 2664.

Which county in kansas has the highest taxes. Johnson County collects the highest property tax in Kansas levying an average of 266400 127 of median home value yearly in property taxes while Osborne County has the lowest property tax in the state collecting an average tax of 59400 15 of median home value per year. Click here for a larger sales tax map or here for a sales tax table. Does kansas have high taxes.

Alcona County Michigan 553 Allegany. The Highest Property Taxes by County. According to the Tax Foundation 2020 mid-year sales tax ranking Kansas has the ninth-highest combined state and local sales tax rate in the nation at 868.

The exact property tax levied depends on the county in Kansas the property is located in. There are a total of 377 local tax jurisdictions across the state collecting an average local tax of 1557. Kansas counties ranked by per capita income.

To view all county data on one page see Kansas property tax by county. What is the sales tax for the state of Kansas. ATTOM Data Solutions reports that the counties with the highest effective tax rate as of 2020 were.

The Lincoln Land Institute found that Iola KS has the highest rural property tax rate in. Hays KS Sales Tax. Over the same time frame inflation is 495 and population growth is 11.

Taxing District 1 paid 1891 million in 2015 taxes with the revenue going to the state Sedgwick. The county in Kansas that has the highest real estate taxes is Johnson County. Beside above what county in Kansas has the highest taxes.

Some of Kansass low economic performance may be tied to the fact that property taxes are growing too fast. Derby KS Sales Tax Rate. El Dorado KS Sales Tax Rate.

The state rate is 65. Great Bend KS Sales Tax Rate. Dodge City KS Sales Tax Rate.

Kansas has the 26th highest per capita income in the United States at 20506 2000. Kansas has 105 counties with median property taxes ranging from a high of 266400 in Johnson County to a low of 59400 in Osborne County. The average local rate is 268 but some local rates exceed 4.

For more details about the property tax rates in any of Kansas counties choose the county from the interactive map or the list below. Gardner KS Sales Tax Rate. Total Sales Tax Rate.

Tax Rates for Kansas KS. Property tax assessed by Kansas counties has grown 164 over the past 21 years according to the Kansas Department of Revenue. In fact 65 KS counties saw triple-digit property tax growth despite their populations shrinking.

Therefore looking at specific counties will give you a better sense of how high property taxes can actually get. Its personal per capita income is 29935 2003. Click any locality for a full breakdown of local property taxes or visit our Kansas sales tax calculatorto lookup local rates by zip code.

Garden City KS Sales Tax Rate. Watercraft County Average Tax Rate and Minimum Value - 2021 WCATR 2020 WCATR 2019 WCATR 2018 WCATR 2017 WCATR 2016 WCATR 2015 WCATR 2014 WCATR. Federal income taxes are not included Property Tax Rate.

Many residents born and raised in Kansas may not realize that the majority of states 32 of them do not tax groceries at all. Its interesting to note that the community of Waldron in Harper County had the highest citywide tax levy of 192 percent and the highest composite levy at 38 percent. 719 sq mi 1862 km 2 Neosho County.

Johnson County has the highest property tax rate per capita at 1786. 695 The total of all sales taxes for an area including state county and local taxes. Andover KS Sales Tax Rate.

Median property tax is 162500. Last year Kansas was ranked 8 with a slightly lower rate of 867. Data is from the 2010 United States Census Data and the 2006-2010 American Community Survey 5-Year Estimates.

Combined with the state sales tax the highest sales tax rate in Kansas is 106 in the city of Shawnee Mission. 106 Zeilen Kansas. The list is sorted by median property tax in dollars by default.

This growth means Kansans are paying roughly 593 million more in taxes than the countys prices or population would dictate. Last updated August 2021. 572 sq mi 1481 km 2 Ness County.

And the Kansas taxing district that coughs up the most in Kansas is right here in Wichita. Kansas has state sales tax of 65 and allows local governments to collect a local option sales tax of up to 41. View City Sales Tax Rates.

Arkansas City KS Sales Tax Rate. 106 Zeilen One of the original 36 counties Formerly Dorn County Nemaha River which passes through the county. 39 Related Question Answers Found Which city.

If you need access to a database of all Kansas local sales tax rates visit the sales tax data page. A handful of states tax groceries at a lower rate. Rank County Per capita income Median household income Median family income Population Number.

You can sort by any column available by clicking the arrows in the header row. Combined with the state sales tax the highest sales tax rate in Kansas is 106 in the city of Shawnee Mission. This interactive table ranks Kansas counties by median property tax in dollars percentage of home value and percentage of median income.

Graphs showing the 21-year change in property taxes. One of the original 36 counties Formerly Dorn County Neosho River which passes through the county. Kansas has one of the highest sales tax rates at an average of 867 which includes a tax on groceries.

1196 The property tax rate shown here is the rate per 1000 of home value. View County Sales Tax Rates. You may ask How much taxes do I pay on my paycheck.

16M 20M Motor Vehicle Appraised Value Chart - 2020 Chart 2019 Chart 2018 Chart. The mean property taxes for this county are 2664. While it can help to consider state averages property taxes are typically set at the county level.

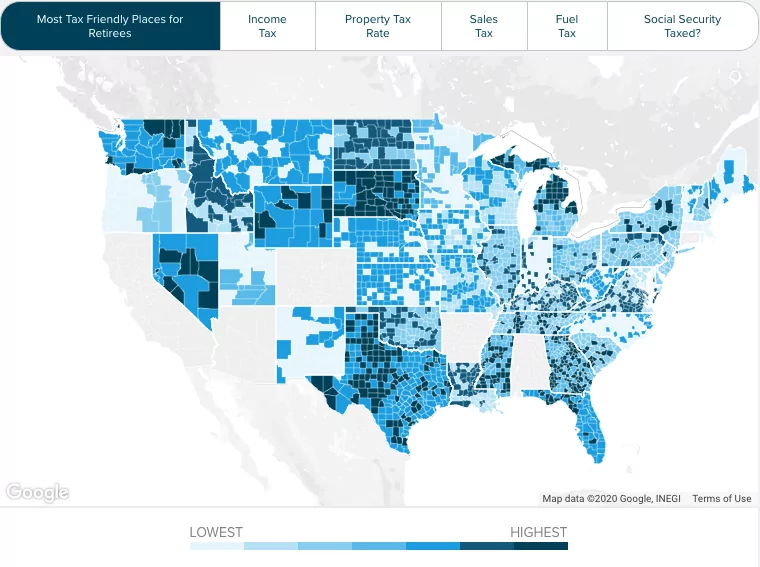

Yahoo News On Twitter Best Places To Retire Retirement Locations Map

States With Highest And Lowest Sales Tax Rates

Which States Have The Highest Income Tax Rates Fedsmith Com

City Of Reno Property Tax City Of Reno

Banking Reserve Financial Regulation

Property Tax Comparison By State For Cross State Businesses

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Colorado Retirement Tax Friendliness Smartasset

Taxation Of Social Security Benefits Mn House Research

Missouri Income Tax Rate And Brackets H R Block

Why Are Texas Property Taxes So High Home Tax Solutions

States With The Highest Sales Tax Rates In The Usa

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

U S States With Highest Gas Tax 2021 Statista

The States With The Highest Capital Gains Tax Rates The Motley Fool

Americans Are Migrating To Low Tax States Native American Map States United States Map

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

Posting Komentar untuk "Which County In Kansas Has The Highest Taxes"